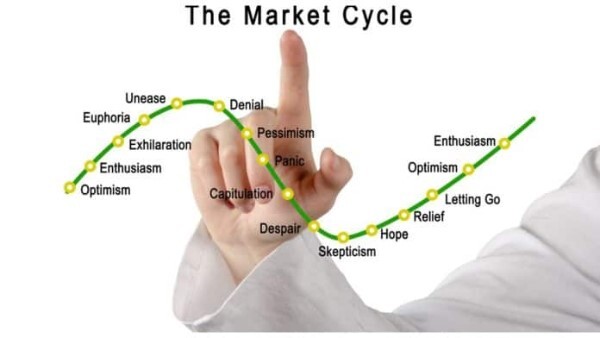

The reason for cyclicality in our world is the involvement of humans because people are emotional and inconsistent. When people feel good about things that are going on and are optimistic about the future, they spend more and save less. This irresponsible borrowing makes their financial position precarious. Remember The Economist's wise words ‘The worst loans are made at the best of times’.

In investing, value can evaporate, an estimate can be wrong, and circumstances can change. However, we can hold on to two concepts with confidence: most things will prove to be cyclical, and some of the best opportunities for gain or loss come when other people forget point number one. Howard Marks in the memo – You cannot predict, you can prepare – says, ‘Cycles are self-correcting and their reversal is not necessarily dependent on exogenous events. They reverse (rather than going....